2020 (For an investment of Rs.2 Lakhs)

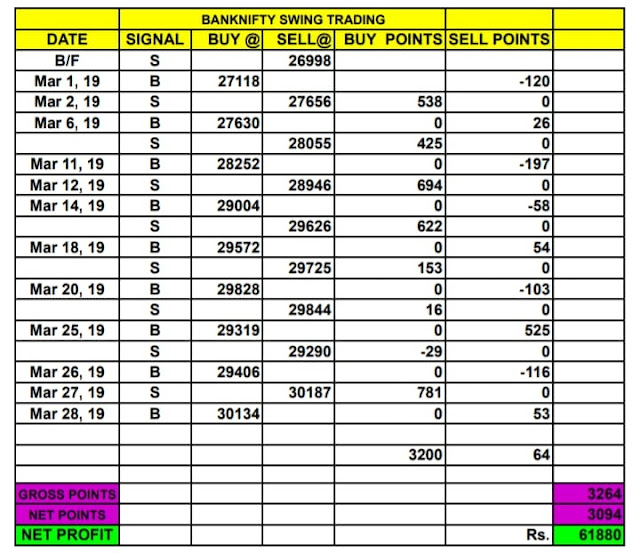

2019 (For an investment of Rs.2 Lakhs)

- Stop and reverse trade with only one lot.

- Lot size 20 quantity.

- Average monthly earnings on investment 24%

2018

This month Nifty opened at 5769 and closed at 5522. A fall of 217 points. But we made a gross profit of 1194 points.We had a net loss of -199 points. We shall multiply this loss by 2 and deduct it from the gross profit. Then we get net profit 796 points. We shall now divide this by 2. Finally We get a Net Profit of 373 points. So, for every 100 quantity of Nifty Future, we have earned Rs.37,300.

April 2011

This month Nifty opened at 5865.10 and closed at 5753.80. A fall of 111 points. But we made a gross profit of 1154 points.We had a net loss of -35 points. We shall multiply this loss by 2 and deduct it from the gross profit. Then we get net profit 1084 points. We shall now divide this by 2. Finally We get a Net Profit of 542 points. So, for every 100 quantity of Nifty Future, we have earned Rs.54,200.

Mar 2011

This month Nifty opened at 5375 and closed at 5824.20. A rise of 449 points. But we made a gross profit of 1028 points.We had a net loss of -37 points. We shall multiply this loss by 2 and deduct it from the gross profit. Then we get net profit 954 points. We shall now divide this by 2. Finally We get a Net Profit of 447 points. So, for every 100 quantity of Nifty Future, we have earned Rs.44,700.

Feb 2011

Crossed one lakh

This

month Nifty opened at 5542 and closed at 5343. A fall of 199 points.

But we made a gross profit of 2157 points. We had a net loss of 70

points. We shall multiply this loss by 2 and deduct it from the gross

profit. Then we get net profit 2017 points. We shall now divide this by

2. Finally We get a Net Profit of 1008 points. So, for every 100 quantity of Nifty Future, we have earned Rs.1,00,800.

Note: From this month onwards we shall deduct double the points we lost and halve the points we earned and calculate the Net profit.

Jan 2011

What a Show!

This month Nifty opened at 6198 and closed at 5523. It has fallen by 675 points. Almost 11% decline. Even in this Ultra Bear Month we have out performed our own performance. Last month we had gained 1098 points. This month we have earned 1736 points. A Growth of 1.5 times. As usual we shall take only 50% of 1736. Then it comes to 868 points. So, for every 100 quantity of Nifty Future, we have earned Rs.86,800.

Dec 2010

we earned a Total of 1191 points and Lost 163 points (due to whipsaws) in Nifty Future. So the Total gain is 1028 points. On January 1st 2010 Nifty future opened at 5225 and on 31st december 2010 it closed at 6164 yielding 940 points for those who had gone long. It took 12 long months. But we gained 1028 points in just one month.

Let us be practical. We can never exit at the peaks and bottoms. So we shall take only 50% of 1028. Now the Total Net Gain is 514 points. If you had traded just 2 lots of Nifty i.e, 100 quantity, you could have easily earned Rs.51,400. Hey man, this is for an investment of Just Rs.60,000(span margin for Nifty). What more can you expect?

No Tension, No Panic. Work like a Disciplined Robot sans emotions. You can Never Lose!

GoodBye 2010